sblanding.ru Market

Market

Should You Keep All Your Money In One Bank

Your money is safe. Keeping cash in your home puts you at risk of theft, fire, flood, loss, or damage. Opening an account at an FDIC-insured bank anywhere. After all, it's your money in there, why should you pay to get at it?! But it hasn't always been this way, 'free' banking only arrived in the UK in the s. If you find yourself transferring money out of your checking account more than once or twice a month, you may need a separate account for your emergency fund. Actual change saved could accrue faster the more you use your debit card. All you need to get started. A checking account with debit card. and. A savings. Although bank money markets are quite safe, not all are FDIC insured. Make sure you know what you're getting when you open a money market account. Certificate. Before you leave our site, we want you to know your app store has its own Easily move money between your Bank of America banking and Merrill Edge. “The checking account is very good at what it does,” Achtermann adds. “But it is only designed to do one thing. It serves as a place to keep your money that you. 7 reasons why separate accounts are good for your marriage · You have premarital savings. · Your spouse has premarital debts · Money has psychological consequences. Therefore, it's typically only a good idea to have more than one bank account if you're confident that you can keep each account funded well beyond any minimum. Your money is safe. Keeping cash in your home puts you at risk of theft, fire, flood, loss, or damage. Opening an account at an FDIC-insured bank anywhere. After all, it's your money in there, why should you pay to get at it?! But it hasn't always been this way, 'free' banking only arrived in the UK in the s. If you find yourself transferring money out of your checking account more than once or twice a month, you may need a separate account for your emergency fund. Actual change saved could accrue faster the more you use your debit card. All you need to get started. A checking account with debit card. and. A savings. Although bank money markets are quite safe, not all are FDIC insured. Make sure you know what you're getting when you open a money market account. Certificate. Before you leave our site, we want you to know your app store has its own Easily move money between your Bank of America banking and Merrill Edge. “The checking account is very good at what it does,” Achtermann adds. “But it is only designed to do one thing. It serves as a place to keep your money that you. 7 reasons why separate accounts are good for your marriage · You have premarital savings. · Your spouse has premarital debts · Money has psychological consequences. Therefore, it's typically only a good idea to have more than one bank account if you're confident that you can keep each account funded well beyond any minimum.

If you're just starting to manage your money, one checking account and one savings account may be enough. But additional accounts can be useful to track your. Holding multiple savings accounts for specific purposes may help prevent spending money earmarked for another purpose and may help simplify tracking your goals. Plus, your money will be federally insured so if your bank or credit union closes, you will get your money back. The maximum amount of money that can be insured. $50 · $5 or; $0 monthly maintenance fee if you: · The cash in your Truist One Savings account may be used to get extra benefits in your Truist personal checking. Everybody has an opinion on how much cash you should keep in your bank account. The truth is, it depends on your financial situation. What everyone needs to. You can use savings accounts to put away money that you'd like to save for the future, for emergencies or to buy expensive purchases like a new car or a holiday. You can keep all your money in the bank sweep or diversify into 5 available With a Vanguard Cash Plus Account and a Vanguard Brokerage Account, you can manage. However, if your amount of money exceeds the deposit limit set by the bank, a certain part of your deposit amount will not be protected in case the bank fails. easy to choose the right checking and savings account. Keep reading to learn about the benefits of our bank accounts and find the one that's right for you. DARRYL: We'll be talking later on about how the FDIC helps keep the money safe that you put in a bank. Page 3. FEDERAL DEPOSIT INSURANCE CORPORATION. Money. However, if your amount of money exceeds the deposit limit set by the bank, a certain part of your deposit amount will not be protected in case the bank fails. Therefore, it's typically only a good idea to have more than one bank account if you're confident that you can keep each account funded well beyond any minimum. There might be a sign at the cash register, or the cashier could inform you. No matter how your check was processed, you should contact your bank right away. Banks and building societies can take money from your current account to cover missed payments on other accounts you have with them. This is called the 'right. We'll waive the monthly maintenance fee each statement cycle you meet one of the following: · Maintain a minimum daily balance of $ or more in your account. But if you regularly struggle to meet these minimums, it might be best to put all your funds in one account at one bank. Financial organization issues – If you. You May Lose Some Money. If you are less-than-perfect at keeping track of your finances, you may be better off with one account – or at least with keeping all. Establishing both your savings account and your checking account at the same bank makes it very easy to transfer money between the two. You can also add a. There are a number of benefits to keeping your money in a bank including safety, cost, security, convenience, and ease of planning for your financial future. Why combine the emergency fund and sinking fund into one account? Because it all ends up being basically the same money. You might think it should be separate.

What Does Collateral Insurance Cover

Collateral Protection Insurance, or CPI for short, is a type of insurance coverage that lenders purchase to protect themselves against potential losses. What is Collateral Protection Insurance? CPI is car insurance purchased by the lender – in this case GECU – when a borrower doesn't have satisfactory coverage. Collateral Protection Insurance, or CPI, insures property held as collateral for loans made by lending institutions. Collateral Protection Insurance pertains to a situation that occurs when your vehicle insurance changes or lapses during the life of a vehicle loan you have. Most importantly, CPI coverage will only cover the lender's interests in the collateral, not yours. Any damages or losses on the collateral will be reimbursed. Collateral Protection Insurance is coverage that protects against physical damage and protects the credit union's interest in your vehicle. CPI insures the creditor's interest in the collateral for physical damage and unrecovered theft. How Does CPI Work? We issue a collateral protection insurance. Collateral Protection Insurance (CPI) insures property held as collateral for loans made by lending institutions. Collateral Protection Insurance protects lenders (financial institutions like you) when the vehicle owner fails to carry their own insurance policy. Collateral Protection Insurance, or CPI for short, is a type of insurance coverage that lenders purchase to protect themselves against potential losses. What is Collateral Protection Insurance? CPI is car insurance purchased by the lender – in this case GECU – when a borrower doesn't have satisfactory coverage. Collateral Protection Insurance, or CPI, insures property held as collateral for loans made by lending institutions. Collateral Protection Insurance pertains to a situation that occurs when your vehicle insurance changes or lapses during the life of a vehicle loan you have. Most importantly, CPI coverage will only cover the lender's interests in the collateral, not yours. Any damages or losses on the collateral will be reimbursed. Collateral Protection Insurance is coverage that protects against physical damage and protects the credit union's interest in your vehicle. CPI insures the creditor's interest in the collateral for physical damage and unrecovered theft. How Does CPI Work? We issue a collateral protection insurance. Collateral Protection Insurance (CPI) insures property held as collateral for loans made by lending institutions. Collateral Protection Insurance protects lenders (financial institutions like you) when the vehicle owner fails to carry their own insurance policy.

For a range of reasons, a vehicle sometimes loses individual insurance coverage. The borrower may fail to pay the premium, or simply allow it to lapse. That's. Briefly, Collateral Protection Insurance protects the credit union from uninsured loss should your vehicle be damaged or lost. However, it does not cover you. In the event a borrower does not provide proof of insurance, Collateral policy declaration page with the full VIN listed and minimum coverage below. If the car is totaled and you don't have insurance coverage to put up cash as a replacement collateral, you can end up having the whole loan due. Collateral protection insurance typically covers physical damage to the vehicle. It may also include medical expenses and liability coverage. Physical. VLDI is a Collateral Protection product for customers who pledge an auto as collateral for their loan and do not have personal automobile insurance coverage. WHAT IS CPI (Collateral Protection Insurance): · WHY DID I RECEIVE A NOTICE ABOUT PROVIDING PROOF OF INSURANCE?: · YOUR INSURANCE POLICY NEEDS TO INCLUDE THE. The program allows the lender to instantly place coverage on collateral when it becomes uninsured. Any lender looking to alleviate risk and reduce charge-offs. CPI doesn't give you liability coverage · Automatically renews each month · Premium and interest is added to loan payment. CPI Insurance (Collateral Protection Insurance) is used by lenders to ensure their collateral is financially covered in case of an accident. Learn more. Collateral-Placed Insurance (CPI), also known as Collateral Protection Insurance or Force-Placed Insurance, is a form of insurance coverage used by lenders. When your members take out an auto loan from your credit union, their loan agreement usually requires that they maintain physical damage insurance to cover the. If a member does not provide proof of insurance or fails to purchase coverage, the credit union may choose to have CPI coverage placed on the loan to protect. It covers the lender so they don't lose money because you didn't purchase the right type of insurance. You get nothing from it. A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Briefly, collateral protection insurance protects the credit union from uninsured loss should your vehicle be damaged or lost. However, it does not cover you. 2) What Does Collateral Protection Insurance Cover? Collateral Protection Insurance protects the borrower and also the lender, when the. (e-1) With respect to collateral protection insurance covering real property, a creditor, at the creditor's option, may obtain insurance that will cover either. Collateral protection insurance includes insurance coverage that is purchased to protect only the interest of the creditor and insurance coverage that is. Collateral Protection Insurance is used by lenders to protect their collateral in case of an accident. CPI will be applied to your loan if we haven't received.

Discover It Student Chrome Vs Student Cash Back

The Discover it Student Chrome credit card offers 2% cash back on the first $1, that you spend at gas stations and restaurants each quarter. That's total. Student Chrome offers just 2% cash back on its bonus category and the category never changes. Both cards cap the amount of spending that earns the higher rate. Discover It Student Chrome earns from gas, while Discover It Student Cash Back from rotating categories. Compare their differences here. The Discover it Student Cash Back card is an ideal card for college students looking to get rewards for their spending. With 5% cash back on rotating categories. The Discover it® Student Chrome card offers one of the most robust intro offers for a student credit card. Discover will match your cash back earnings. With the Discover It Student Chrome card, cardholders receive 2% cash back at gas stations and restaurants on up to $1, worth of combined quarterly purchases. Discover it Student Chrome is more notable than Discover it Student Cash Back due to its higher effective reward rate and consistent cash back on gas and dining. Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. So you could turn $50 cash back to $ Or. Chrome for Students Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more. The Discover it Student Chrome credit card offers 2% cash back on the first $1, that you spend at gas stations and restaurants each quarter. That's total. Student Chrome offers just 2% cash back on its bonus category and the category never changes. Both cards cap the amount of spending that earns the higher rate. Discover It Student Chrome earns from gas, while Discover It Student Cash Back from rotating categories. Compare their differences here. The Discover it Student Cash Back card is an ideal card for college students looking to get rewards for their spending. With 5% cash back on rotating categories. The Discover it® Student Chrome card offers one of the most robust intro offers for a student credit card. Discover will match your cash back earnings. With the Discover It Student Chrome card, cardholders receive 2% cash back at gas stations and restaurants on up to $1, worth of combined quarterly purchases. Discover it Student Chrome is more notable than Discover it Student Cash Back due to its higher effective reward rate and consistent cash back on gas and dining. Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. So you could turn $50 cash back to $ Or. Chrome for Students Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more.

As with other Discover cards, this one provides the Freeze-it on/off switch and free FICO credit scores. This cash rewards credit card gives you access to US-. This card earns 2% cash back at gas stations and restaurants on up to $1, in combined purchases each quarter and 1% cash back on all other purchases. *The. Card details · INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. · Earn 2% cash back at Gas Stations and Restaurants on up to. Additionally, cardholders can enjoy a 2% cash back on gas and restaurant purchases (up to $1, per quarter) and 1% back on all other purchases. Compare Discover it® Chrome for Students to other credit cards · No Annual Fee · Earn 2% cash back in popular categories. · Get an unlimited dollar-for-dollar. Discover it® Chrome for Students is a student credit card with a cash back rewards program focused on gas station and restaurant purchases, plus some nice. 5. Discover It Student Chrome Card The Discover It Student Chrome card has a competitive cash back rewards program. Cardholders get 1% cash back on all. This card made it easy for me to learn about how to use a credit card while also earning cash back! It was super convenient to control from the app and gain. Rewards Rate 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the. The Discover it® Student Cash Back offers higher earning potential than the Discover it® Student Chrome. However, students who spend frequently on gas and. While both options are student cards, the main differences between them are that the Discover it Student Cash Back has rotating bonus categories, while the. The Discover It Student Chrome earns 2% cashback on purchases of up to $1, at restaurants and gas stations each quarter. After that, unlimited 1% cashback. We also offer the Discover it® Miles Travel Card, Discover it® Chrome Gas and Restaurants Card and NHL® Discover it® Card. Students can choose a cash. INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you've earned at the. Rewards rate. The Discover it® Student Chrome lets you earn 2% cash back at Gas Stations and Restaurants on up to $1, in combined purchases each quarter. While both cards have similar qualification requirements and no annual fee, Discover it® Student Chrome offers you the ability to earn 2% cash back at Gas. Overall, Discover it Student Cash Back is strongly recommended based on community reviews that rate customer service and user experience. Discover it Student Cash Back; NHL Discover it. Other Discover cards have a variations on the cashback rewards structure.6 The Discover it Chrome and. Earning Rewards With the Discover it® Student Chrome · 2% cash back at gas stations and restaurants on up to $1, in combined purchases each quarter (then 1%). Ready to apply for the Discover it® for Students Card? FICO® Credit Score Terms: Your FICO® Credit Score, key factors and other credit information are based.

Signs Your House Has Foundation Problems

Foundation Repair Problem Signs · Stair-step brick cracking. Ever notice cracks within your brickwork or blocked foundation that follow up in a stair-step. One of the most common and noticeable signs of foundation problems is the appearance of cracks in walls and floors. One of the most visible signs of foundation issues is the presence of cracks in the walls and floors of a home. DFW area homes with slab or pier and beam foundations are frequently affected by soil, volatile temperatures, water and more. Cracks multiply over time and. Cracked walls, bulging floors, and doors that won't close are some of the signs of foundation issues. foundation problems. Learn how to determine the cause of the issue your house for some of the following telltale signs of issues with your foundation. How are your doors closing in the interior? Rubbing? Ghosting? Do you have any ground directly around the perimeter of the house that is. 1. Large Diagonal Cracks in Foundation Walls (Exterior Walls) · 2. Sticking Doors That Won't Latch · 3. Cracks in Wood Floors or Floor Tiles · 4. Cracking in. A bulge or curve in either a block foundation or a poured concrete wall could signal that the foundation has shifted, or that the soil around your foundation. Foundation Repair Problem Signs · Stair-step brick cracking. Ever notice cracks within your brickwork or blocked foundation that follow up in a stair-step. One of the most common and noticeable signs of foundation problems is the appearance of cracks in walls and floors. One of the most visible signs of foundation issues is the presence of cracks in the walls and floors of a home. DFW area homes with slab or pier and beam foundations are frequently affected by soil, volatile temperatures, water and more. Cracks multiply over time and. Cracked walls, bulging floors, and doors that won't close are some of the signs of foundation issues. foundation problems. Learn how to determine the cause of the issue your house for some of the following telltale signs of issues with your foundation. How are your doors closing in the interior? Rubbing? Ghosting? Do you have any ground directly around the perimeter of the house that is. 1. Large Diagonal Cracks in Foundation Walls (Exterior Walls) · 2. Sticking Doors That Won't Latch · 3. Cracks in Wood Floors or Floor Tiles · 4. Cracking in. A bulge or curve in either a block foundation or a poured concrete wall could signal that the foundation has shifted, or that the soil around your foundation.

Interior and exterior cracks could be a sign of minor settling, but it could also be a sign of foundation problems. Often, one of the most obvious signs of foundation issues are the cracks, gaps, and fractures that appear in the home's foundation and in other parts of the. Are you dealing with new construction foundation cracks? One of the most obvious signs of foundation troubles is the presence of cracks in your walls, floors or. Warning Signs of Foundation Damage · 1. Drywall Cracks or Floor Cracks · 2. Sticking Doors and Windows · 3. Floor and Wall Gaps · 4. Sagging or Uneven Floors. 1. Doors Stick or Don't Latch · 2. Large Cracks on Foundation Walls · 3. Cracking on Interior Walls · 4. Cracks in Floor Tiles or Wood Floors · 5. Windows Sticking. 1. Doors Stick or Don't Latch · 2. Large Cracks on Foundation Walls · 3. Cracking on Interior Walls · 4. Cracks in Floor Tiles or Wood Floors · 5. Windows Sticking. Signs of foundation problems can include very noticeable issues — such as your entire house leaning slightly to one side — or very small cracks in basement. House or slab foundation problems can cause walls to separate from the ceiling. Other warning signs include cracks splintering up the walls, any wall that is. 1. Exterior Cracks. As the house settles, fine cracks might appear on the foundation walls. · 3. Crawlspace and Basement Moisture. The space below your home's. Cracks, Cracks, Everywhere · Cracks in exterior or interior brick walls · Cracked or bowed walls · Displaced or cracked moulding · Cracks in the floor tile · Cracks. How do you recognize a problematic house foundation? Great question! Here are some signs of problems to look for. If you notice uneven floors or cracks in the drywall around doors and windows, then that is a pretty sure sign of foundation shifting. Contact a. In our area your house is likely. Cracks, Cracks, Everywhere · Cracks in exterior or interior brick walls · Cracked or bowed walls · Displaced or cracked moulding · Cracks in the floor tile · Cracks. When you start to feel comfortable, you notice not one problem in your home; it's everything piling together. Cracks are on your ceiling, windows and doors are. #1) Wall Cracks and Fractures As a house settles in its early years, it's common for tiny hairline cracks (approximately 1/16” in size) to develop in the. When your foundation is beginning to fail, doors that used to function properly begin to give you problems. As the foundation shifts, the house begins to settle. Houses settle over time, and a little unevenness isn't cause for panic. At the same time, you'll want to be alert to these warning signs that more dramatic. Here's everything you need to know about common foundation problems, their underlying causes, and how you can catch them early. Signs of foundation problems can include very noticeable issues — such as your entire house leaning slightly to one side — or very small cracks in basement.

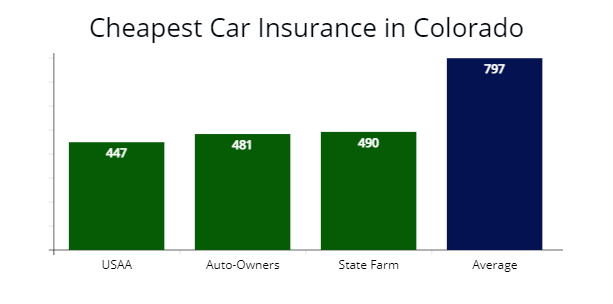

Colorado Car Insurance Average

Get Cheap Car Insurance In Colorado ; Average monthly cost in Colorado · year-olds · $ ; Average monthly cost in Denver · Good drivers · $ ; Average. All Colorado drivers are required to have liability insurance. This covers only the other car and/or other driver when an accident is determined to be your. The average cost of car insurance in Colorado was $1, in according to sblanding.ru That's 10% higher than the national average. Of course, your auto. The average driver in Colorado pays $1, [1] per year for their auto insurance, but many people pay much more—often to make up for bad drivers. Root doesn't. Colorado Car Insurance Requirements · Bodily injury: $25, per person, $50, per accident · Property damage: $15, per accident · Uninsured motorist: $25, Chevrolet Colorado Insurance Rates ; Countryway Insurance, $ ; Mercury Insurance, $ ; MMG Insurance Company, $ ; Patriot Group, $ How much is car insurance in Colorado? Car insurance costs an average of $ per month in Colorado, for a liability-only policy from Progressive. *Read. Auto insurance for a Chevrolet Colorado will cost about $2, per year. This beats the national average for popular pickup models by $ Our car insurance. With an average insurance rate of about $ annually, car insurance in Colorado runs about 14 percent higher than the national average. Get Cheap Car Insurance In Colorado ; Average monthly cost in Colorado · year-olds · $ ; Average monthly cost in Denver · Good drivers · $ ; Average. All Colorado drivers are required to have liability insurance. This covers only the other car and/or other driver when an accident is determined to be your. The average cost of car insurance in Colorado was $1, in according to sblanding.ru That's 10% higher than the national average. Of course, your auto. The average driver in Colorado pays $1, [1] per year for their auto insurance, but many people pay much more—often to make up for bad drivers. Root doesn't. Colorado Car Insurance Requirements · Bodily injury: $25, per person, $50, per accident · Property damage: $15, per accident · Uninsured motorist: $25, Chevrolet Colorado Insurance Rates ; Countryway Insurance, $ ; Mercury Insurance, $ ; MMG Insurance Company, $ ; Patriot Group, $ How much is car insurance in Colorado? Car insurance costs an average of $ per month in Colorado, for a liability-only policy from Progressive. *Read. Auto insurance for a Chevrolet Colorado will cost about $2, per year. This beats the national average for popular pickup models by $ Our car insurance. With an average insurance rate of about $ annually, car insurance in Colorado runs about 14 percent higher than the national average.

Among SelectQuote customers, the average car insurance cost in Colorado is $+. Our Auto Insurance Partners in Colorado. Like home insurance. State Farm's average rate for Colorado drivers with good credit and a clean driving record. $/mo* Find similar. *Quotes generated for Insurify users from. The average cost of high-risk car insurance in Colorado is $2,, but it varies depending on what's on your record. Drivers with DUI in Colorado pay $1, The average cost of car insurance in Denver is $2, Undocumented immigrants can get driver's licenses in Colorado. How Much Does Car Insurance Cost in Denver. What is the average cost of car insurance in Colorado? Colorado drivers paid an average of $1, a year for full coverage (liability, collision and. Cheap Minimum Liability Car Insurance Companies in Colorado · Progressive: $50 per month · Direct Auto Insurance: $59 per month · Allstate: $68 per month. The average cost of car insurance for minimum-coverage in Colorado Springs, Colo., is roughly $54 per month or $ per year. This is about 5% more than the. Full coverage for a Colorado normally runs around $ per month, while liability only auto insurance rates average about $ ACG is the most affordable car. Savings vary in CO and are an average of savings off the Home policy combining the Multiple Policy Discount for having Auto insurance with Allstate and the. We have found that on average, the cost of a minimum liability auto insurance policy in Colorado State is $ per month. Sun Coast offers the cheapest car. Car insurance quotes in Colorado The average cost of full coverage car insurance in Colorado is $ for a six-month policy, which is 23% more expensive than. In Colorado, drivers who own their home will usually pay around $ per month while drivers who rent usually average in around $ Homeownership, Avg. Comparing rates from thousands of insurance policyholders in Colorado, the average cost of minimum liability coverage is $ per month or $1, per year. The. Private Passenger Automobile Premium Comparison Report. The Colorado Division of Insurance has created this report, to provide consumers an opportunity to. That adds up to an average annual premium drop from $1, in compared to $ in or an average savings of $ per car. For consumers who purchased. The typical annual auto insurance rate in California is $ pricier than the average expense in Colorado. In Colorado, drivers who own their home will usually pay around $ per month while drivers who rent usually average in around $ Homeownership, Avg. Auto insurance in Colorado costs an average of $ for limited coverage and $ for maximum coverage. Colorado's premiums are much higher than the national. Colorado car insurance coverage requirements · $25, of bodily injury liability coverage per person. This helps cover expenses for the injuries or deaths of. American National tends to offer the most affordable rates on average at about $29 per month or $ per year for minimum coverage and $ per month or $

How To Reduce Amt Tax

Net income is then reduced or increased by AMT adjustments, and increased by tax preference items to arrive at "pre-adjustment AMTI." At this point, the. To prevent this, Congress adopted a tax policy requiring high-income individuals to pay at least some tax. It created the Alternative Minimum Tax (AMT) to. To minimize the risk of triggering the AMT, consider strategies like deferring capital gains, maximizing retirement contributions, managing deductions carefully. The AMT was designed to prevent wealthy taxpayers from using tax loopholes to avoid paying taxes. Because historically the exemption from the AMT had not. How to Reduce the AMT · Participate in a (k), (b), SARSEP, (b) plan, or SIMPLE IRA by making the maximum allowable salary deferral contributions. · Make. Indexing the AMT for inflation, allowing deductions for dependent exemptions, and allowing personal credits against the AMT would reduce the number of AMT. For example, you could accelerate or delay certain transactions, such as selling an asset with a large gain, to minimize triggering the AMT. It can be used in subsequent years to reduce the regular tax. This credit is equal to the difference of the AMT computed with and without the preference income. Discover how the wealthy minimize AMT: reduce income, time deductions strategically, and leverage tax credits to preserve more income for investment. Net income is then reduced or increased by AMT adjustments, and increased by tax preference items to arrive at "pre-adjustment AMTI." At this point, the. To prevent this, Congress adopted a tax policy requiring high-income individuals to pay at least some tax. It created the Alternative Minimum Tax (AMT) to. To minimize the risk of triggering the AMT, consider strategies like deferring capital gains, maximizing retirement contributions, managing deductions carefully. The AMT was designed to prevent wealthy taxpayers from using tax loopholes to avoid paying taxes. Because historically the exemption from the AMT had not. How to Reduce the AMT · Participate in a (k), (b), SARSEP, (b) plan, or SIMPLE IRA by making the maximum allowable salary deferral contributions. · Make. Indexing the AMT for inflation, allowing deductions for dependent exemptions, and allowing personal credits against the AMT would reduce the number of AMT. For example, you could accelerate or delay certain transactions, such as selling an asset with a large gain, to minimize triggering the AMT. It can be used in subsequent years to reduce the regular tax. This credit is equal to the difference of the AMT computed with and without the preference income. Discover how the wealthy minimize AMT: reduce income, time deductions strategically, and leverage tax credits to preserve more income for investment.

Tax legislation—Inflation Reduction Act. For tax years beginning after , a percent corporate alternative minimum tax (AMT) is imposed on the adjusted. The alternative minimum tax (AMT) applies to high-income taxpayers by setting a limit on those benefits, helping to ensure that they pay at least a minimum. You will be able to claim $30, in AMT Credit for that year. This leaves the remaining $20, to be claimed later on. Complex Example. As a sample. The amount of additional tax paid in a year under the AMT rules is generally available to be deducted from tax payable in the following seven taxation years, to. The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits. You may be able to lower the AMT impact simply by exercising ISOs when the price difference between the options' exercise price and the stock's fair market. Taxpayers who expect a potential AMT problem may be able to use certain strategies to reduce their taxes. For example, if a tax projection indicates that you. After you subtract the exemption amount from AMTI, the remaining income will be subject to the AMT rate. The AMT rate is a flat 26% for income up to $, ($. According to the IRS, certain tax benefits that are allowed under tax law can reduce a taxpayer's tax amount by a significant degree. The worksheet that lets. The AMT was designed to reduce a taxpayer's ability to avoid taxes by using certain deductions and other tax benefit items. The taxpayer's tax liability for. The Alternative Minimum Tax (AMT) is a separate tax system that requires some taxpayers to calculate their tax liability twice. Refigure your depletion deduction for the AMT. To do so, use only income and deductions allowed for the AMT when refiguring the limit based on taxable income. The major reasons for the reduction of AMT taxpayers after TCJA include the capping of the state and local tax deduction (SALT) by the TCJA at $10,, and a. The AMT exemption for is $, for married couples filing jointly, up from $84, before the enactment of the TCJA in (table 1). For singles and. In this case, the Foreign Tax Credit will not apply as a dollar-for-dollar credit as it typically would—but it will help you reduce your taxes all the same. The AMT ensures that certain taxpayers pay their fair share or at least a minimum amount of tax. · It doesn't kick in until income reaches beyond a certain. AMT can limit certain deductions and tax benefits, potentially increasing your overall tax liability. Effective tax planning, such as managing income and. In the example above, you would use $10, of your AMT credit to reduce your tax liability from $25, to $15, Any additional unused credit would be. These benefits can significantly reduce the regular tax of high income earners. AMT sets a limit on the benefits that can be used to reduce tax. Taxes deducted. $95, is the most AMT credit we can use for the taxable year. If we have remaining AMT credit, we can carry it forward and use it for future years. We have an.

Ways To Increase Your Credit Limit

How to ask for a credit limit increase: Make an online request, call your credit card company, or open a new credit card with a higher limit. Having a lower total available credit without reducing your spending will drive your percentage ratio up. You can ask for a limit increase on another card or. Your best potential for growth of your Capital One limit is by reporting the highest statement balances possible, then paying them off in full. To freely explore our digital banking services without using your own account, visit our Digital Banking Simulators page. 1. Wait for an automatic credit-limit increase. Chase, like many other credit card companies, may automatically increase your credit limit if you demonstrate a. This article gives an overview of how to improve your credit score fast and reliably, including the 4 biggest-impact tips you can implement this week. If you want a credit line increase on your Discover credit card, call the number on the back of your card and talk to a customer service representative or log. The second way you may get a credit limit increase is if a credit card company increases your limit without a request from you. This typically occurs after you'. Because your lender sets your credit limit, they can adjust it up or down in response to changes in your financial profile. On the plus side, some lenders even. How to ask for a credit limit increase: Make an online request, call your credit card company, or open a new credit card with a higher limit. Having a lower total available credit without reducing your spending will drive your percentage ratio up. You can ask for a limit increase on another card or. Your best potential for growth of your Capital One limit is by reporting the highest statement balances possible, then paying them off in full. To freely explore our digital banking services without using your own account, visit our Digital Banking Simulators page. 1. Wait for an automatic credit-limit increase. Chase, like many other credit card companies, may automatically increase your credit limit if you demonstrate a. This article gives an overview of how to improve your credit score fast and reliably, including the 4 biggest-impact tips you can implement this week. If you want a credit line increase on your Discover credit card, call the number on the back of your card and talk to a customer service representative or log. The second way you may get a credit limit increase is if a credit card company increases your limit without a request from you. This typically occurs after you'. Because your lender sets your credit limit, they can adjust it up or down in response to changes in your financial profile. On the plus side, some lenders even.

When talking to a representative, be polite and clear about why you believe you qualify for a higher credit limit. If you're given the chance to ask for a. You can follow these simple steps to help improve it. Rule 1: Make. Every. Payment. Late payments can stay on your record for up to 7 years. In this article, we'll talk about why your credit limit is important, reasons to increase your credit limit, when and how to request a credit line increase. What to Do When Your Credit Card Is Maxed Out · Pay down the balance · Request a credit limit increase · Transfer the balance · Credit counseling. How to Increase Your Credit Limit · Request a Higher Credit Limit Online · Wait for an Automatic Credit Limit Increase · Add to a Secured Credit Card's Security. To request a credit limit increase · Log on to online banking. · Choose the relevant credit card from the account summary screen. · Select 'Manage' on the right. Here's six smart tips to increase your credit card limit that suit your needs. 1. Boost Your Credit Score 2. Repay dues on time 3. Check Credit Utilisation. To request a credit limit increase on your American Express Card, log into your account and navigate to the credit limit increase request form or simply call. The best practice is to pay your credit card bills in full every month. If you can't, pay as much as possible. Try to keep your credit utilization rate below. How do I increase my credit line?Expand. To request a credit limit increase, please call the number on the back of your card or on your statement. What if I. To potentially improve your odds of a credit limit increase, keep your account in good standing, pay your bills on time, and maintain a lower utilization rate. How Do You Request a Credit Limit Increase? To request a credit limit increase, call your card issuer's customer service number (generally on the back of your. How often you can request a credit limit increase depends on the card issuer, but unless you've received an increase within the last six months, many will let. Here's how to build credit fast: Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a credit limit. It's possible to increase credit limit. This will work if you have been using your Credit Cards successfully, paying all your dues in time and making the best. One of the most convenient ways to request a credit line increase is using our app or website. If you don't already have an online account, you can sign up. Submit a request through Online Banking Customer Services: look for “Request a credit limit increase” listed under “Banking Services.”. Asking for a higher credit limit can be as simple as calling the credit card company or completing an online form. 1. Pay down your revolving credit balances. If you have the funds to pay more than your minimum payment each month, you should do so. This guide will give you a few actionable tips to help improve that all-important credit score. #1 - Register your address.

Coinbase Pro Whitelisting

I have tried 2 different APIs. I am entering all of the correct information from Coinbase Pro. I keep getting an Access Denied error. I do not have Whitelisting. Coinbase Pro has one extra capacity that adds extra wellbeing and security. Coinbase Pro people can save and furthermore whitelist digital currency addresses. Allowlisting is an opt-in security feature that limits sends to only the crypto addresses in your address book. The crypto addresses can be external or belong. Support Center for sblanding.ru | Bitcoin & Cryptocurrency Exchange | Bitcoin Adding and confirming a new cryptocurrency withdrawal address on Kraken Pro. Coinbase effectively has two platforms, Coinbase and Coinbase Pro. Coinbase Whitelisting crypto addresses is an increasingly common feature among exchanges. Furthermore, you can set up address whitelisting involving a seven-day Previously only Coinbase Pro used this structure. For most trades you'll pay. Whitelisting is an optional security feature that allows crypto withdrawals to only be sent to verified addresses stored in the Address Book. Whitelisting. Momentarily, Coinbase Pro cryptocurrency trading is limited to Bitcoin, Ethereum and Litecoin. IP whitelisting should be set at unrestricted. Because. Device Whitelisting: Coinbase Pro allows users to whitelist specific devices, ensuring that only trusted devices can access their accounts. IP Address. I have tried 2 different APIs. I am entering all of the correct information from Coinbase Pro. I keep getting an Access Denied error. I do not have Whitelisting. Coinbase Pro has one extra capacity that adds extra wellbeing and security. Coinbase Pro people can save and furthermore whitelist digital currency addresses. Allowlisting is an opt-in security feature that limits sends to only the crypto addresses in your address book. The crypto addresses can be external or belong. Support Center for sblanding.ru | Bitcoin & Cryptocurrency Exchange | Bitcoin Adding and confirming a new cryptocurrency withdrawal address on Kraken Pro. Coinbase effectively has two platforms, Coinbase and Coinbase Pro. Coinbase Whitelisting crypto addresses is an increasingly common feature among exchanges. Furthermore, you can set up address whitelisting involving a seven-day Previously only Coinbase Pro used this structure. For most trades you'll pay. Whitelisting is an optional security feature that allows crypto withdrawals to only be sent to verified addresses stored in the Address Book. Whitelisting. Momentarily, Coinbase Pro cryptocurrency trading is limited to Bitcoin, Ethereum and Litecoin. IP whitelisting should be set at unrestricted. Because. Device Whitelisting: Coinbase Pro allows users to whitelist specific devices, ensuring that only trusted devices can access their accounts. IP Address.

Go back to your Coinbase Pro browser window or tab and click the Create API Key button at the bottom. The IP Whitelist field should be left blank. Optional. users can also recover their accounts through the password recovery mechanism. By implementing additional security measures such as withdrawal whitelisting and. Create a coinbase pro account. · Setup your Coinbase Pro account portfolios (portfolios are also referred to as profiles). · Create the API key for the portfolio. whitelisting, and other security options to help Coinbase Pro's 10, but Coinbase Pro supports trading in over cryptocurrencies. -. With whitelisting, you can have preset addresses that you can withdraw funds to. Funds cannot be withdrawn to addresses not on that list. New. Whitelisting and transaction confirmations Choose between the Basic mode, the easiest way to buy and sell crypto, or the Pro mode, built for pro traders and. Select Coinbase Pro from the list of exchanges, and then copy the API key and the Secret into the designated fields. Confirm your entries by clicking Create. In addition to whitelisting addresses for funds withdrawal for your exchange account, Coinbase also offers whitelisting of IP addresses it will accept API. Yes. I've seen the notifications. Plus this appeared in my feed. Coinbase Phasing Out 'Pro' Exchange for 'Advanced' Mode in Main App I see that my whitelist. Coinbase Advanced replaced Coinbase Pro as an improved advanced trading platform. Customers will see the same low volume-based fees as Coinbase Pro and do not. in your whitelist when creating your API key. As of January , Quadency has migrated previous API support for Coinbase and Coinbase Pro connections to. Connecting to the market data for Coinbase Pro does not require the user to have a Coinbase Pro account. In order to trade on Coinbase Pro through Medved. This means HodlBot cannot actually withdraw cryptocurrency from your account. Keep the IP whitelist blank because we have servers with dynamic IP addresses. Connecting to the market data for Coinbase Pro does not require the user to have a Coinbase Pro account. In order to trade on Coinbase Pro through Medved. 6. Enter the IP Whitelist addresses. To find updated IP addresses, go to the connecting Coinbase Advanced exchange page and take the IP addresses from there. Binance security features also include address whitelisting, device management, and the ability to restrict device access. Like Coinbase, all USD balances are. Please do NOT whitelist IPs for Coinbase API imports. The API data is not compatible with the CSV data. To import Staking transactions please do a back up under. We have IP whitelisting as a base security layer. On top of that, we have unique encryption per user, and trading can only be done from authorized devices. Security Measures: Coinbase Pro offers various security options, including two-factor authentication, withdrawal whitelisting, and API key permissions.

How Much Money Is 5000 Streams On Spotify

How much revenue does a song generate per million plays on Spotify? A song on average generates between $ and $ per million plays on Spotify. These. Boost your Spotify presence with our premium promotion services. Increase streams, followers, and engagement. Explore budget-friendly, results-driven. 5, streams generate around $20, depending on the listener's location, how often the song is played, and the type of subscription. Spotify Streams Can Greatly. So many artists come to us after they buy Spotify plays/streams. top fake Let's say that you buy Spotify plays/streams at $10 for 5, streams. If. Considering that the average payout for each stream is $, he should be earning a lot more than that. But, with so many stakeholders. stream, we can estimate the revenue generated by a million streams on Spotify. An artist could expect to earn between $3, and $5, for a million streams. Our royalties calculator gives you an estimate of how much you could earn on streaming platforms like Spotify, Apple Music and Google Play. Spotify, Apple Music and more as well as the different factors that affect royalty payments. How much do music streaming services pay artists? Music. Using Spotify's average payout rate, 5, streams might earn you around $15 to $ Again, this is an estimate, and the actual earnings can vary. How much. How much revenue does a song generate per million plays on Spotify? A song on average generates between $ and $ per million plays on Spotify. These. Boost your Spotify presence with our premium promotion services. Increase streams, followers, and engagement. Explore budget-friendly, results-driven. 5, streams generate around $20, depending on the listener's location, how often the song is played, and the type of subscription. Spotify Streams Can Greatly. So many artists come to us after they buy Spotify plays/streams. top fake Let's say that you buy Spotify plays/streams at $10 for 5, streams. If. Considering that the average payout for each stream is $, he should be earning a lot more than that. But, with so many stakeholders. stream, we can estimate the revenue generated by a million streams on Spotify. An artist could expect to earn between $3, and $5, for a million streams. Our royalties calculator gives you an estimate of how much you could earn on streaming platforms like Spotify, Apple Music and Google Play. Spotify, Apple Music and more as well as the different factors that affect royalty payments. How much do music streaming services pay artists? Music. Using Spotify's average payout rate, 5, streams might earn you around $15 to $ Again, this is an estimate, and the actual earnings can vary. How much.

On average, Spotify pays artists between $ and $ per stream. That equals a revenue split of 70/30 for the recording owners and Spotify. The short answer is that it pays artists $$ per stream and the approximate revenue split of 70/ 70% provided to the artists and 30% to Spotify. many other places within a person's library. Even a small package of Spotify streams can do wonders for your music. Quickly Became Popular on the Platform. So many artists come to us after they buy Spotify plays/streams. top fake Let's say that you buy Spotify plays/streams at $10 for 5, streams. If. Spotify, on average, pays artists $ per thousand streams. With our Spotify Royalty Calculator, you can estimate your earnings and make informed. Get Organic Spotify Growth with Pitch-Us. Secure + Targeted Streams and unlock Spotify's Algorithmic Playlists. Instant start and Money-back guarantee. Therefore, artists receive royalties based on the overall Spotify stream count. The average Spotify royalty rate is between $ and $, but it can vary. Of the 10 million streams in total, your song was streamed 1, times. 1,/10,,*$1,= $ owed. Spotify has a great video that explains how. When you research how much each stream pays you from Spotify, Apple 5, streams is $20 and most shirts sell good at around that. Therefore, artists receive royalties based on the overall Spotify stream count. The average Spotify royalty rate is between $ and $, but it can vary. If an artist has millions of streams, why don't they earn more? I heard Spotify pays a fraction of a penny per stream, is that true? Why does “per stream rate”. streams, the rest are under streams. My figures, while low, show do away with the annual streams requirement. This will protect most. We'll try to explain how much your music could be earning in streaming royalties from platforms like Spotify, Apple Music and more. This means that for every million streams, an artist might earn between $3, and $5, How Much Does Spotify Pay Per Stream in 5 min read. Jan 4. What this means is - Artist with less than streams per year (monetized at around $40) will not be paid. - 2/3 of the Music on Spotify will. monthly Spotify listeners. Some even have a couple hundred 3How much money is k streams on Spotify? The average payout is $$ In fact, just this week, Spotify has taken down hundreds of thousands of songs for suspected “artificial” streams. Many of the artists, whose songs were. How much does spotify pay per stream? The amount Spotify pays per stream varies depending on several factors, such as the country where the stream occurs and. Buy Spotify Plays ✓ % Safe ✓ Real ✓ Cheapest price ✓ Organic delivery in a few days. Buy now to maximize your social media and music promotion! How Much Does Spotify Pay Per Stream? Spotify's payout for artists depends 5, streams? Reply. Miles. December 27, Hello, I just started my.

Costar License Cost

license fees plus additional fees based upon our usage. Management and CoStar Connect® CoStar Connect allows commercial real estate firms to license. Lower Total Cost of Ownership. Fewer cameras, licenses, cables, installations, and required accessories; Equipment is compatible with existing infrastructure. Consider CoStar, only If you're capable to spend $ dollars per year for a single subscription. The cost is very high because of the quality of information. CoSTAR is the most cost-effective way to add client/server functionality to your existing application. CoSTAR licenses. Can I share copies of CoSTAR. Brokerages are $ per user per month, investors/developers are $ for 5 users per month. This is for data for the entire country. Arecont Vision. AV Costar AV-CWS5Y Contera Web Services Classic - 5 Year Subscription (One Per Camera). Sale price$ CoStar Real Estate Manager Alternatives Pricing ; VTS · $20, per year ; Brokermint · $ per month ; Property Matrix · $1. Per Unit. The most comprehensive platform for commercial real estate information, analytics and news · WATCH VIDEO · The Power of CoStar · Commercial property data for a. I owned a company that operated as a commercial real estate brokerage. We had 34 brokers of which a 1/3 we paid for licenses. The license was a. license fees plus additional fees based upon our usage. Management and CoStar Connect® CoStar Connect allows commercial real estate firms to license. Lower Total Cost of Ownership. Fewer cameras, licenses, cables, installations, and required accessories; Equipment is compatible with existing infrastructure. Consider CoStar, only If you're capable to spend $ dollars per year for a single subscription. The cost is very high because of the quality of information. CoSTAR is the most cost-effective way to add client/server functionality to your existing application. CoSTAR licenses. Can I share copies of CoSTAR. Brokerages are $ per user per month, investors/developers are $ for 5 users per month. This is for data for the entire country. Arecont Vision. AV Costar AV-CWS5Y Contera Web Services Classic - 5 Year Subscription (One Per Camera). Sale price$ CoStar Real Estate Manager Alternatives Pricing ; VTS · $20, per year ; Brokermint · $ per month ; Property Matrix · $1. Per Unit. The most comprehensive platform for commercial real estate information, analytics and news · WATCH VIDEO · The Power of CoStar · Commercial property data for a. I owned a company that operated as a commercial real estate brokerage. We had 34 brokers of which a 1/3 we paid for licenses. The license was a.

CoStar protects its informational base by registering its copyrights, photographs, and databases. CoStar customers pay a license fee based on the number of. license fees plus additional fees based upon our usage. 8. Management and CoStar Advertising® CoStar Advertising offers property owners and brokers a highly. Pricing for our software is determined by the number of leases and/or locations you need to manage. Our system is SaaS (cloud-based) with low-cost. Fees. Subject to the terms of any applicable License Agreement: You are responsible for the timely payment, using the currency and payment method indicated. A licensed CoStar customer may do so in the ordinary course of its business in connection with marketing a property that the customer owns, controls, represents. A reward of up to 25% of any monetary payment (net of any legal and other costs and subject to reward program terms and conditions). Are there exceptions to. The new format now has Loop net as a stand alone marketing site, you will be able to see commercial listing there, and there will be a fee to. The Service is an online subscription service provided by CoStar to Fee Terms or otherwise pay the Subscription Fees associated with such Subscription. NAR Member Offer: 25% off subscription cost for saying 'NAR' and 'I'm a CoStar. CoStar is the largest provider of commercial real estate research. To encourage clients to use our services regularly, we generally charge a fixed monthly amount for our subscription-based services rather than charging fees. See detailed pricing plans for CoStar Real Estate Manager. Compare costs with competitors and find out if they offer a free version, free trial or demo. You'll also create powerful reports to help you identify portfolio cost savings. Real estate teams can't afford to miss a thing. Don't miss the No. 1. To encourage clients to use our services regularly, we generally charge a fixed monthly amount for our subscription-based services rather than charging fees. license terms and withdraw the CoStar service for all UWE Bristol students. Access from outside the UK. Although CoStar is available to students at partner. CoStar. Access a full market Windows. Cost: No Cost. Available to: Faculty; Students. Campuses: Ann Arbor. Permitted Use: Instruction. License Information. If you currently hold licenses for both Benchmarking and CoStar product, your pricing structure already encompasses the comprehensive value of our complete. fixed periodic license fees or a combination of fixed periodic license fees plus additional fees based upon our usage. Page 6. Management and Quality. Headquartered in Washington, D.C., the technology company donated 50 licenses to the Ole Miss School of Business Administration, giving students access to. The beachside house with an asking price of $21 million is being pitched as a potential second home. CoStar Insight. Expanding Retail Tenants Remain Active in. cost-effectively and efficiently identify suppliers with whom to do business. Following supplier registration and to become a COSTARS supplier, businesses.

1 2 3 4 5