sblanding.ru Recently Added

Recently Added

How To Convert Ira To Gold

Fund your new IRA; Select approved precious metals; Arrange for IRS-approved storage. Research and Choose a Gold IRA Custodian. The first step in converting. Interested in a Gold retirement plan- Swiss America has the answers for converting regular IRAs, Roth IRAs & (k) plans into a Precious Metals IRA- Call a. Investors can open gold IRAs through a broker-dealer or other custodian. Key Takeaways. A gold IRA is a retirement account that allows its investors to hold. ***The amount you convert to a Roth IRA isn't subject to the 10% penalty that's charged on traditional IRA withdrawals taken before you reach age 59½. You. Investors are converting k retirement accounts to gold and silver. Lear Capital is ready to help transfer your funds into a self-directed precious metals. A Gold IRA is a unique investment avenue within an Individual Retirement Account, allowing investors to include gold, along with other approved precious metals. Steps to Convert IRA to Gold · Step 1: Determine Your Eligibility · Step 2: Choose a Gold IRA Provider · Step 3: Open a Gold IRA Account · Step 4: Fund Your. To put IRA funds into gold, you have to establish a self-directed IRA. This is a type of IRA that the investor manages directly and is permitted to own a wider. How to Convert Your IRA to a Gold IRA · Choose a gold IRA company: · Open an account with your investment firm: · Initiate a distribution or rollover from your. Fund your new IRA; Select approved precious metals; Arrange for IRS-approved storage. Research and Choose a Gold IRA Custodian. The first step in converting. Interested in a Gold retirement plan- Swiss America has the answers for converting regular IRAs, Roth IRAs & (k) plans into a Precious Metals IRA- Call a. Investors can open gold IRAs through a broker-dealer or other custodian. Key Takeaways. A gold IRA is a retirement account that allows its investors to hold. ***The amount you convert to a Roth IRA isn't subject to the 10% penalty that's charged on traditional IRA withdrawals taken before you reach age 59½. You. Investors are converting k retirement accounts to gold and silver. Lear Capital is ready to help transfer your funds into a self-directed precious metals. A Gold IRA is a unique investment avenue within an Individual Retirement Account, allowing investors to include gold, along with other approved precious metals. Steps to Convert IRA to Gold · Step 1: Determine Your Eligibility · Step 2: Choose a Gold IRA Provider · Step 3: Open a Gold IRA Account · Step 4: Fund Your. To put IRA funds into gold, you have to establish a self-directed IRA. This is a type of IRA that the investor manages directly and is permitted to own a wider. How to Convert Your IRA to a Gold IRA · Choose a gold IRA company: · Open an account with your investment firm: · Initiate a distribution or rollover from your.

Gold IRA Rollover & k · Watch Our 3-part Video Series on Gold IRA Rollovers · Frequently Asked Questions · Our Gold and Silver Coin Top Picks for Your (k). A Gold IRA rollover moves funds from one type of retirement savings plan, like a (k), to a different type of retirement savings plan—in this case, a Gold IRA. No. When performed correctly, a rollover or transfer of assets into a Precious Metals IRA takes place with no taxes or penalties. To put IRA funds into gold, you have to establish a self-directed IRA. This is a type of IRA that the investor manages directly and is permitted to own a wider. Converting your existing IRA to a Gold IRA requires a methodical approach. This process entails carefully choosing a reputable gold IRA company, familiarizing. Once the old taxation laws were rewritten, it became possible for individuals to place gold and other precious metals into their IRAs, but not just any IRA. It. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. In summary, converting your IRA to a gold IRA is manageable with the right custodian and company. Reputable firms make it easy, requiring minimal effort from. Investors can open gold IRAs through a broker-dealer or other custodian. Key Takeaways. A gold IRA is a retirement account that allows its investors to hold. How To Convert Ira To Gold. likes. Protect Your retirement With Physical Gold sblanding.ru You are also permitted to move tax-advantaged funds from one account to another so the Taxpayer Relief Act lets you convert your IRA to Gold without facing any. You can convert your k to gold by rolling it over into a self-directed IRA. Once the funds are in your account, you can then purchase gold. You will need to. Can I buy physical gold for my Individual Retirement Account (IRA) or (k)?. To Find Out How SchiffGold Can Help You Convert Your IRA or (k) into Physical Gold. Frequently Asked Questions. Can I buy & own physical Gold & Silver coins. Yes. Many clients elect to do a partial IRA rollover to a Gold IRA. You may elect to move only a portion of your IRA or retirement account to a. Properly done, there should be no tax liability from converting your standard IRA to a gold IRA. Your IRA fund manager will know how to do. Once you reach 59½, distributions may be taken from a gold IRA. You must start taking required minimum distributions (RMDs) from your retirement account. Once you sell your precious metals, you can transfer the IRA funds to another retirement account. Your new custodian will have to submit a transfer request. Investing in precious metals through a Gold IRA offers stability and security for your retirement savings. At IRAxp, we provide a range of IRA-eligible precious. No, you cannot store your gold IRA at home due to legal restrictions. Gold IRAs require appointing a custodian to store your gold in a secure, insured, and IRS-.

Operations Management Methods

Methods Analysis Methods analysis focuses on how a task is accomplished. Whether controlling a machine or making or assembling components. View our library of operations management techniques · Backsourcing · Balanced Scorecard · Benchmarking · Better Outbound Marketing · Budgeting Processes · Bullwhip. Operations management includes three levels: strategic, tactical, and operational. The strategic level defines company goals, and the tactical level outlines a. Operations management is a professional and modern template that contains six stylish and fully editable slides. What Are the Inventory Management Techniques You'll Learn About? · Setting safety stock levels and reorder points. · Managing relationships with key vendors. Operations management is crucial for customer satisfaction, production quality, and employee satisfaction. Key responsibilities include managing processes. Operations management is focused on the efficient running of business processes designed to maximize output and results within an organization. Put simply. Operations management involves managing the operations and processes of an organization. · Some of the functions performed by an operations manager include. Operations Strategy. Operations strategy refers to the methods companies use regarding their operations in a market place. It is concerned with setting broad. Methods Analysis Methods analysis focuses on how a task is accomplished. Whether controlling a machine or making or assembling components. View our library of operations management techniques · Backsourcing · Balanced Scorecard · Benchmarking · Better Outbound Marketing · Budgeting Processes · Bullwhip. Operations management includes three levels: strategic, tactical, and operational. The strategic level defines company goals, and the tactical level outlines a. Operations management is a professional and modern template that contains six stylish and fully editable slides. What Are the Inventory Management Techniques You'll Learn About? · Setting safety stock levels and reorder points. · Managing relationships with key vendors. Operations management is crucial for customer satisfaction, production quality, and employee satisfaction. Key responsibilities include managing processes. Operations management is focused on the efficient running of business processes designed to maximize output and results within an organization. Put simply. Operations management involves managing the operations and processes of an organization. · Some of the functions performed by an operations manager include. Operations Strategy. Operations strategy refers to the methods companies use regarding their operations in a market place. It is concerned with setting broad.

Best practices in operations management · quality management standards and systems · stock control, delivery and supply chain management · purchasing and. Best practices in operations management · quality management standards and systems · stock control, delivery and supply chain management · purchasing and. Operations management is crucial for customer satisfaction, production quality, and employee satisfaction. Key responsibilities include managing processes. The first decisions facing operations managers come at the planning stage. At this stage, managers decide where, when, and how production will occur. They. Operations management relies on several key methodologies such as forecasting, product design, supply chain management, quality control, and capacity planning. The process of striking this balance is called inventory control, and companies now regularly rely on a variety of inventory-control methods. Just-in-Time. Operations management is a permanent process where a company oversees the manufacturing process. In contrast, project management can focus on a variety of areas. 5 Tips That Operations Managers Can Use Today · Make Sure You're Focusing on the Right Operations Metrics · Always Use Data to Identify Key Problems · Invest in. The job of operations management (OM), then, consists of all the activities involved in transforming a product idea into a finished product. Operations management is the management of business processes to match supply with customer demand in a profitable way. Learn more about this important. Operations management refers to the administration of business practices to create the highest level of efficiency possible within an organization. Operations Management, as a field, deals with the production of goods & services. It is defined as decision making in the operations function & integration of. Operations management is concerned with designing and controlling the production of goods and services, ensuring that businesses are efficient in using. Operations management is concerned with the design, management, and improvement of the systems that create the organisation's goods or services. The majority of. Operations management is an administrative function that seeks to ensure high levels of business and organizational efficiency. There are three ways that firms strategize to meet mission: differentiation, cost leadership, and response. Operations managers turn these into tasks to be. In this article, we will give an overview of quantitative model-based research in OM, focusing on research methodology. Operations Management and Logistics: Fundamental Principles and Methods Operations management and logistics lies at the heart of every organization, whether. METHODS ANALYSIS Methods analysis is the study of how a job is done. Whereas job design shows the structure of the job and names the tasks within the. Developing strategies. An important aspect of operations management involves developing strategies to optimize resources. These strategies could include.

Grocery Ad Comparison

Use this handy Grocery Price Comparison Tool to locate the best prices at your local grocery stores including ShopRite, Stop & Shop, Safeway, Kroger, Publix. review sales ads and place information from them into the price book as well. When you go to the grocery store I suggest taking your grocery price book with. Figure Out Which Grocery Stores Have the Best Deals on Which Products. This might take some time to do, but careful comparison shopping at different grocery. Grocery Outlet Weekly Ad. Your selected store. None. Pick a Store. Login. Grocery-Price-Comparison-Vons-Grocery-Outlet. Basket is a smart app that price checks shopping items between stores. Comparing prices to find the best deals and promotions, Basket is the ideal app. differences among supermarkets. Here are the prices for the store brands of some common household items at each of the most popular grocery stores in the area. Flipp is your one-stop marketplace for savings and deals. Browse weekly ads from retailers near you, or search for the items you need. Our ratings of Washington area grocery chains and stores report how each stacks up for price and quality. To compare prices, our researchers used a item. Find ads and deals at nearby stores. · Search for any item to compare prices at different stores. · Save weekly ad deals and grocery coupons to your shopping list. Use this handy Grocery Price Comparison Tool to locate the best prices at your local grocery stores including ShopRite, Stop & Shop, Safeway, Kroger, Publix. review sales ads and place information from them into the price book as well. When you go to the grocery store I suggest taking your grocery price book with. Figure Out Which Grocery Stores Have the Best Deals on Which Products. This might take some time to do, but careful comparison shopping at different grocery. Grocery Outlet Weekly Ad. Your selected store. None. Pick a Store. Login. Grocery-Price-Comparison-Vons-Grocery-Outlet. Basket is a smart app that price checks shopping items between stores. Comparing prices to find the best deals and promotions, Basket is the ideal app. differences among supermarkets. Here are the prices for the store brands of some common household items at each of the most popular grocery stores in the area. Flipp is your one-stop marketplace for savings and deals. Browse weekly ads from retailers near you, or search for the items you need. Our ratings of Washington area grocery chains and stores report how each stacks up for price and quality. To compare prices, our researchers used a item. Find ads and deals at nearby stores. · Search for any item to compare prices at different stores. · Save weekly ad deals and grocery coupons to your shopping list.

Meet Flipp, the digital platform that will supercharge your savings on groceries, electronics and more. Browse the best deals and the latest weekly ads from. A woman smiles at the grocery store while grocery shopping and holding her phone. Getty Images. With food costs surging, groceries can quickly eat up your. Grocery Store Weekly Ad Comparison including ShopRite, Stop & Shop, Safeway, Kroger, Publix and more. Amazon vs Walmart: Who Has the Cheapest Prices? · Amazon Fresh. Amazon Fresh is an online and physical grocery store that offers low prices, same-day delivery. Search local stores to compare prices of everyday products, find in store unadvertised sales, coupons and save up to 60% on your shopping trip. Flipp is your one-stop marketplace for savings and deals. Browse weekly digital flyers from retailers near you, or search for the items you need. Fight food waste with Misfits Market's online grocery delivery Save up to 30%* compared to regular grocery store prices; Checkmark Skip an. Simplify your life with WiseList. Compare grocery prices, plan healthy meals, track bills, and achieve your goals – all in one place. Grocery Outlet Weekly Ad. Your selected store. None. Pick a Store. Login. Grocery-Price-Comparison-Vons-Grocery-Outlet. What did we do? On March 13 we purchased similar products at each of the five stores: Dorothy Lane Market, Dot's Market, Kroger, Walmart and Meijer. Store. Empower your decision-making with WiseList. Guiding Australians to compare, save, and access exclusive deals on grocery, insurance, loans, energy, and more. Weekly Ad · Shop · Digital Coupons · Privacy Policy · Terms of Use · Billing & Return © Compare Foods NC. An error has occurred making your request. Compare Brand Names vs. Store Brands for ingredients to make Peanut Butter Cookies. This project uses a website to comparison shop. How are you shopping today? In-Store. View the weekly ad and clip coupons at your local store. Pickup. Same day pickup. Same store selection. Same store pricing. Welcome to MyGroceryDeals: the best way to find grocery deals from your favorite local stores. Our Deal Gallery provides you with a flexible way of browsing. Weekly Ad · My Store · Store Locator · Store Services & Amenities · FAQ · Compare TV · Shop · Compare Club · Benefits · Points Tracker · Redemption Policy. Check your pantry · Make a grocery list · Compare stores · Use coupons · Don't shop hungry · Leave the big spenders at home · Keep a running tally of your cart's cost. Welcome to MyGroceryDeals: the best way to find grocery deals from your favorite local stores. Our Deal Gallery provides you with a flexible way of browsing. Meat can very well be the priciest part of your grocery purchase. If you buy during a 50% markdown, you could easily save money each month. See: Comparing. If you're wondering how to compare weekly grocery ads, try an app like Flipp that enables you to “flip through” all of the weekly grocery sales flyers for.

Best Way To Day Trade Crypto

Building a Winning Strategy for Day Trading Cryptocurrency · Step #1: Choose High Volatility/Liquidity Coins · Step #2: Apply the Money Flow Index (MFI) Indicator. Selecting the right crypto day trading exchange is vital for effective trading. Top choices like Binance, Kraken, KuCoin, Bitget, and Exolix excel in security. Best Cryptos For Day Trading: Bitcoin, Ethereum, Binance Coin, Ripple (XRP), Solana. Factors Determining The Price Movement in Cryptos. Day trading in the cryptocurrency market offers the potential for quick profits but comes with high levels of risk and stress. It's a strategy suited for. If you want to day trade, find an exchange with Crypto Futures. That's where the big day traders play. ByBit, MEXC, KuCoin and those types of. For example, if you, as a day trader, seek one good day trade per day, you may try to find potential pivot and reversal points within that day. Let's look at. The largest crypto exchange in the world, Binance offers relatively low fees, low slippage, and more than a thousand trading pairs for crypto day traders. Even the largest cryptocurrency, Bitcoin – that's worth around $1 trillion, has daily price swings that usually makes it suitable for day trading. In addition. It's an investment style where individuals buy and sell cryptocurrencies within the same trading day. The goal? To capitalize on short-term. Building a Winning Strategy for Day Trading Cryptocurrency · Step #1: Choose High Volatility/Liquidity Coins · Step #2: Apply the Money Flow Index (MFI) Indicator. Selecting the right crypto day trading exchange is vital for effective trading. Top choices like Binance, Kraken, KuCoin, Bitget, and Exolix excel in security. Best Cryptos For Day Trading: Bitcoin, Ethereum, Binance Coin, Ripple (XRP), Solana. Factors Determining The Price Movement in Cryptos. Day trading in the cryptocurrency market offers the potential for quick profits but comes with high levels of risk and stress. It's a strategy suited for. If you want to day trade, find an exchange with Crypto Futures. That's where the big day traders play. ByBit, MEXC, KuCoin and those types of. For example, if you, as a day trader, seek one good day trade per day, you may try to find potential pivot and reversal points within that day. Let's look at. The largest crypto exchange in the world, Binance offers relatively low fees, low slippage, and more than a thousand trading pairs for crypto day traders. Even the largest cryptocurrency, Bitcoin – that's worth around $1 trillion, has daily price swings that usually makes it suitable for day trading. In addition. It's an investment style where individuals buy and sell cryptocurrencies within the same trading day. The goal? To capitalize on short-term.

The Crypto Day Trading Playbook: The Top Day Trading Strategies for Trading Bitcoin and Cryptocurrency Altcoins in ! How to trade on Coinbase: Coinbase is another fully functioning crypto exchange where you can trade cryptocurrency and fund your account with fiat currency. How to Day Trade Crypto · Open a Cryptocurrency Brokerage Account · Fund your account · Choose a platform to trade on · Choose crypto to invest in · Choose a trading. Even the largest cryptocurrency, Bitcoin – that's worth around $1 trillion, has daily price swings that usually makes it suitable for day trading. In addition. To start, you'll need to open an account with a cryptocurrency exchange or a broker such as Skilling that offers crypto CFDs. Then, develop a trading strategy. The strategy of crypto day trading entails entering and exiting a position in the market on the same day within crypto trading hours. It's also known as. Yes, day trading is one of the best ways to make money with crypto. Trying to hold long-term can be risky because of the volatility on the charts. If you buy at. The strategy of crypto day trading entails entering and exiting a position in the market on the same day within crypto trading hours. It's also known as. That's where GoodCrypto really shines – it is probably the best trading platform for cryptocurrency on mobile devices, allowing you to access 20+ exchanges, set. Moving Average Crossovers. Trading moving average (MA) crossovers requires an understanding of MAs, and crossover trading strategies. · Relative Strength Index . The first step when looking at how to day trade cryptocurrency will require you to find a good exchange. A cryptocurrency exchange will allow you to buy and. ByBit. ByBit is famous for being one of the world's best crypto derivative exchanges! ByBit offers crypto derivatives and allows you to trade crypto with up to. Liquidity – day traders should pick crypto assets that can easily be sold for fiat, stablecoins, or other tokens. Ideally, the selected cryptocurrencies are. PrimeXBT is the best exchange to day trade bitcoin and gets a rating of /5 due to its robust day trading tools and thanks to the multi-chart interface. Day trading contrasts with the long-term trades underlying buy-and-hold and value investing strategies. Day trading may require fast trade execution. Visit sblanding.ru and select the Log In button (upper right-hand corner). · After you have logged in to your account, you will be able to make trades on. ATAIX is one of the best crypto exchanges for day trading. It lets you trade 60+ cryptocurrencies including popular options like Bitcoin, Ethereum, Litecoin. First, you can buy and sell actual crypto coins on an exchange. In this instance, you'd need to pay the full value of the coins upfront, in addition to opening. One of the most popular methods of trading on the crypto market is day trading, often known as intraday trading. Although intraday trading is when professional. Top 5 crypto day trading strategies ✋ · 1. Range Trading. Generally speaking, markets behave in two ways; they are either in a trend (up or down) or rangebound.

Non Profit Organization Tax

Most charitable nonprofits that are recognized by the IRS as tax-exempt have an obligation to file IRS Form , which is an annual information return. A nonprofit may apply for tax-exempt status from the Internal Revenue Service. non-profit organize can vary depending on the organization's mission. Please. Nonprofit organizations are exempt from federal income taxes under subsection (c) of the Internal Revenue Service (IRS) tax code. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may. Nonprofit Organizations and Corporate Income Tax · the organization has "unrelated trade or business taxable income" according to I.R.C. s. , or · it is filing. A (c)(3) organization is a non-profit corporation formed to carry out a charitable, religious, literary, educational or scientific purpose that is recognized. Thanks to their tax-exempt status, not-for-profit organizations are not subject to most forms of taxation, including sales tax and property taxes. In most cases. Nonprofit organizations may include religious, educational, or charitable organizations and may not be required to pay federal taxes. However, if you are an. Tax Issues for Nonprofits Neither a nonprofit corporation nor an unincorporated nonprofit association is automatically exempt from federal or state taxes. Most charitable nonprofits that are recognized by the IRS as tax-exempt have an obligation to file IRS Form , which is an annual information return. A nonprofit may apply for tax-exempt status from the Internal Revenue Service. non-profit organize can vary depending on the organization's mission. Please. Nonprofit organizations are exempt from federal income taxes under subsection (c) of the Internal Revenue Service (IRS) tax code. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may. Nonprofit Organizations and Corporate Income Tax · the organization has "unrelated trade or business taxable income" according to I.R.C. s. , or · it is filing. A (c)(3) organization is a non-profit corporation formed to carry out a charitable, religious, literary, educational or scientific purpose that is recognized. Thanks to their tax-exempt status, not-for-profit organizations are not subject to most forms of taxation, including sales tax and property taxes. In most cases. Nonprofit organizations may include religious, educational, or charitable organizations and may not be required to pay federal taxes. However, if you are an. Tax Issues for Nonprofits Neither a nonprofit corporation nor an unincorporated nonprofit association is automatically exempt from federal or state taxes.

(c) organizations can receive unlimited contributions from individuals, corporations, and unions. For example, a nonprofit organization may be tax-exempt. Nonprofit entities are not automatically exempt from paying sales tax on goods and taxable services, even if they are exempt from state and federal income. Yes! Nonprofit organizations that have been granted tax-exemption by the IRS are required to file an IRS Form , annual information return. Nonprofit. Organizations can lose their (c)(3) tax exempt status by distributing earnings to shareholders, engaging in political activity or substantial lobbying, or. Most nonprofit organizations qualify for federal income tax exemption under one of 25 subsections of Section (c) of the Internal Revenue Code. Most. A (c)(3) organization is a non-profit corporation formed to carry out a charitable, religious, literary, educational or scientific purpose that is recognized. This article applies to organizations in the US only. Some types of organizations in the United States, such as churches, that meet the requirements of IRC. The organization must be exempt from federal income taxation under Sections (c) (3), (c) (4) or (c) (19). If the organization has annual gross receipts. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may. Once exempt from this tax, the nonprofit will usually be exempt from similar state and local taxes. If an organization has obtained (c)(3) tax exempt status. Find and check a charity using Candid's GuideStar. Look up (c)(3) status, search s, create nonprofit organizations lists, and verify nonprofit. Nonprofit organizations are generally taxed like any other business. They must pay business and occupation (B&O) tax on gross revenues generated from regular. Which Organizations Are Here? Every organization that has been recognized as tax exempt by the IRS has to file Form every year, unless they make less than. Organizations can lose their (c)(3) tax exempt status by distributing earnings to shareholders, engaging in political activity or substantial lobbying, or. The is the tax form the Internal Revenue Service (IRS) requires all (c)(3) tax-exempt charitable and nonprofit organizations to submit annually. The. In order to qualify as a tax exempt organization (i.e., exempt from Federal taxation under Internal Revenue Code (IRC) Section (a)), a student organization. OVERVIEW. The fact that a nonprofit organization qualifies for an exemption from income tax under section (c) of the Internal Revenue Code. organization if the Division of Taxation determines that it is qualified for exemption from. Sales and Use Tax according to the criteria provided in N.J.S.A. A (c)(3) organization is a nonprofit organization deemed tax-exempt by the IRS. Learn everything you need to know about nonprofit status in this guide! Nonprofit Organizations and Corporate Income Tax · the organization has "unrelated trade or business taxable income" according to I.R.C. s. , or · it is filing.

How To Make A Lot Of Money On Stock Market

Instead of buying a single stock or two stocks, you should trade many quality stocks (with good fundamentals) so as to reduce your overall risk. For investors. Trading safe-haven assets; Trading currencies; Going long on defensive stocks; Choosing high-yielding dividend shares; Trading options; Buying at the bottom. 4) Stay in cash during a Bear Market. 5) Never argue with the Stock Market; it is always right. 6) Concentrate your stock buying and watch your stocks closely. However, until an investor sells a stock, their money stays tied up in the market. investing in various stocks rather than holding a lot of cash. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. You're distracted and engaged. It's the juxtaposition between taking action and being a passive investor that really helps put your stock market losses into. 1. Play the stock market. · 2. Invest in a money-making course. · 3. Trade commodities. · 4. Trade cryptocurrencies. · 5. Use peer-to-peer lending. · 6. Trade. Through every type of market, William J. O'Neil's national bestseller How to Make Money in Stocks has shown over 2 million investors the secrets to. Understanding the Basics of Trading · Step 1 Buy low. · Step 2 Sell high. · Step 3 Do not sell in a panic. Instead of buying a single stock or two stocks, you should trade many quality stocks (with good fundamentals) so as to reduce your overall risk. For investors. Trading safe-haven assets; Trading currencies; Going long on defensive stocks; Choosing high-yielding dividend shares; Trading options; Buying at the bottom. 4) Stay in cash during a Bear Market. 5) Never argue with the Stock Market; it is always right. 6) Concentrate your stock buying and watch your stocks closely. However, until an investor sells a stock, their money stays tied up in the market. investing in various stocks rather than holding a lot of cash. How To Buy Stocks · Direct Stock Plans Through Companies Some companies allow you to buy or sell their stock directly through them without using a broker. You're distracted and engaged. It's the juxtaposition between taking action and being a passive investor that really helps put your stock market losses into. 1. Play the stock market. · 2. Invest in a money-making course. · 3. Trade commodities. · 4. Trade cryptocurrencies. · 5. Use peer-to-peer lending. · 6. Trade. Through every type of market, William J. O'Neil's national bestseller How to Make Money in Stocks has shown over 2 million investors the secrets to. Understanding the Basics of Trading · Step 1 Buy low. · Step 2 Sell high. · Step 3 Do not sell in a panic.

Stock market investing for growth · Research – As a self-directed investor, it will serve you well to develop an analytical mindset. · Invest and build your. How to Make the Stock Market Make Money for You: Warren, Ted: Books - sblanding.ru Investing in the stock market offers a way to grow your money over time as you live your life, with the goal being that you will reap the rewards in the. 1. Profit The first number to look at when learning about how to make money in the stock market is whether the company is turning a profit. Profits are what's. So the two ways to make money with stocks are Dividends and Capital Gains. Investors should have a clear understanding of their strategy before purchasing stock. You can either take the dividends in cash or reinvest them to purchase more shares in the company. Investors seeking predictable income may turn to stocks that. Making Money In The Market There are two basic ways to profit from investing. The first way is to buy stocks or other investments on an exchange, and then. The best way to do this is through dollar-cost averaging. This means regularly investing money into the stock market, such as $ from every. As a shareholder, you can make money in two ways: if the company's value goes up, your stock can be worth more, and you might sell it for a profit. Plus, some. Historically, the returns of the three major asset categories – stocks, bonds, and cash – have not moved up and down at the same time. Market conditions that. Cash can't match the return available in the market, so don't leave your money in cash balances. Look for stocks that are likely to go up and down a lot. Older. 2. Exchange-traded funds (ETFs) If you're worried about researching and selecting individual stocks, an alternative is to invest (either exclusively or. Purchasing anything to earn extra money in future by price rising is called as investment. · If you choose a good and financially strong company, and do invest. How to Make Money in Stocks Canada. By Andrew Goldman. 10 min read. What's easier than making a fortune in the stock market? Losing one. A few easy-to-. If the most difficult part - actually earning money through day trading - is successful and the profits are booked on the securities account, then but the. Many people have lost significant amounts of money in pursuit of the next big thing in the financial markets. Successful investing requires diversification. It's the power of compounding which helps you make money in the stock market. Even a little money of ten thousand rupees being invested in good companies. According to the Pew Research Center, even among families who earn less than $35, per year, one-in-five have assets in the stock market. Investing is less. In a nutshell: Stocks can help companies and investors make money. For companies, money comes from the payments they receive when investors first buy their. Make a Business Plan. When you started your own business, you probably didn't expect to turn a profit within the first month. You had to pay off your.

How Much Do Book Publishers Charge

We believe all authors have the power to develop the marketing mindset needed to build a readership. Success starts with a strategic book marketing & promotion. I have heard that cover art typically run from $$ and hiring an editor is usually $$ Success starts with a strategic book marketing & promotion plan (average industry cost: $), social media coaching from a trained industry expert ($), and. The costs can range widely based on the level of service and quality. On average, self-publishing can cost anywhere from $1, to $10, or more, depending on. As a guide, printing 1, copies of a good quality book of approx. pages will cost between $ to $ per unit or $8, to $12, The standard book royalty rate is 15%. However, this number can vary depending on the publisher, the format of the book, and other factors. How long do book. Publishers' margins · the cost of acquisition, including royalty advances and write-offs · the cost of preparing the text (often including an index and sourcing. These kinds of royalties are often called “list royalties” or “retail royalties.” Occasionally publishers pay Authors “royalties on net sales.” Publishers sell. Some examples of reputable hybrids and their various costs · Atmosphere Press: $5, or more, depending on add-ons · Palmetto Publishing: $11, We believe all authors have the power to develop the marketing mindset needed to build a readership. Success starts with a strategic book marketing & promotion. I have heard that cover art typically run from $$ and hiring an editor is usually $$ Success starts with a strategic book marketing & promotion plan (average industry cost: $), social media coaching from a trained industry expert ($), and. The costs can range widely based on the level of service and quality. On average, self-publishing can cost anywhere from $1, to $10, or more, depending on. As a guide, printing 1, copies of a good quality book of approx. pages will cost between $ to $ per unit or $8, to $12, The standard book royalty rate is 15%. However, this number can vary depending on the publisher, the format of the book, and other factors. How long do book. Publishers' margins · the cost of acquisition, including royalty advances and write-offs · the cost of preparing the text (often including an index and sourcing. These kinds of royalties are often called “list royalties” or “retail royalties.” Occasionally publishers pay Authors “royalties on net sales.” Publishers sell. Some examples of reputable hybrids and their various costs · Atmosphere Press: $5, or more, depending on add-ons · Palmetto Publishing: $11,

In other words, they pay the publisher between 25% to 35% of the cover price on books they actually sell. The books must be returnable, and they will often be. Publishers don't charge you anything at all. Publishers pay the author. If a so called Publisher charges you then they are Vanity Press/Publishers. All legitimate publishers do not require any payment to publish your book. If someone asks you for money, they are not a legitimate publisher. The cost can range from $ – $70, It all depends on what you need and making sure that you hire the right people. As you can see, the cost of self-publishing a book varies greatly, ranging from under $1, to over $5, Total publishing costs depend on various book. Publishers' margins · the cost of acquisition, including royalty advances and write-offs · the cost of preparing the text (often including an index and sourcing. Some publishing houses take no profit off sales, while others take 15 percent (or more). Some houses pay author royalties every month; others pay them every. Self-published authors can earn up to 70% royalties from their books, while most traditionally published authors make % royalties which they only receive. How much a publisher will do for your book depends on the size and resources of the publisher and the size of the advance. That said, even when. There's no cost to the author with traditional publishing: publishers undertake the entire financial risk, handling every aspect of publication at their own. These kinds of royalties are often called “list royalties” or “retail royalties.” Occasionally publishers pay Authors “royalties on net sales.” Publishers sell. Publishers set the recommended retail price of a book, and retailers and distributors acquire copies from the publisher at a discount. The discount to major. Some examples of reputable hybrids and their various costs · Atmosphere Press: $5, or more, depending on add-ons · Palmetto Publishing: $11, For self-publishing, average fees can range from $1, to $5,, depending on the services utilized. These fees typically cover editing, design, formatting. For eBooks, from around $ on Fiverr. For printed books, from around $ for a professional interior formatting, but it can be $+ for more complex works. How much does it cost to market a book? · Hiring a publicist or marketing professional: This can cost anywhere from a few hundred to several thousand dollars. How Much Do Publishers Charge to Publish a Book? · Editing: $ - $3, · Cover Design: $ - $1, · Formatting: $50 - $ · Printing: Costs vary based on the. The cost of publishing a book can vary from hundreds to thousands of dollars, depending on book formatting, design, publishing platform, and more. We print. In a typical traditional publishing deal, the publisher will take around % of the revenue from book sales, with the remainder going to the author. This. In traditional publishing, the royalty rate is often negotiated between the author and the publishing house as part of the publishing contract. These rates can.

Undervalued Consumer Discretionary Stocks

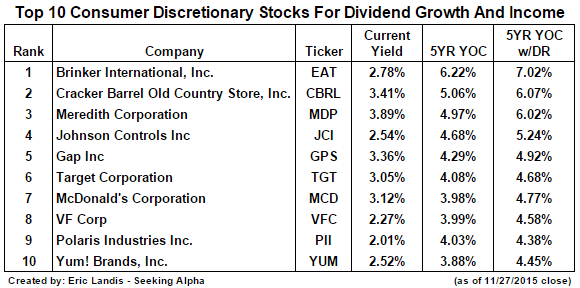

Companies in this sector include Philip Morris International, Procter & Gamble, and Walmart. Show More. Market Cap. T. Market Weight. For the year period ended 7/29/22, the cumulative total return on the S&P Consumer Discretionary Index was %, compared to %. What is next for consumer discretionary stocks. US consumers bucked expectations in Will they do it again in ? “S&P'S GICS Consumer Discretionary Sector Index is cap-weighted Undervalued, Overvalued. Agenda. Sector Overview. Business Analysis. Economic. Undervalued Consumer Cyclical Stocks ; Adient PLC. ADNT · $ ; Advance Auto Parts Inc. AAP · $ ; Alibaba Group Holding Ltd ADR. BABA · $ ; sblanding.ru XLY tracks a market-cap-weighted index of consumer-discretionary stocks drawn from the S&P Sector. Sector. Asset Class. Equity. Region. North America. Good long term consumer discretionary stock? I have an IRA portfolio set up that I manage myself. I'm within about years of retirement. %. 1Y. %. Key Executive exercised options and sold Rm worth of stock. Aug ITE. R Italtile. 7D. %. 1Y. %. Now 20% undervalued. Aug Academy Sports & Outdoors (NASDAQ:ASO) is the third most undervalued consumer cyclical stock based on WallStreetZen's Valuation Score. Academy Sports & Outdoors. Companies in this sector include Philip Morris International, Procter & Gamble, and Walmart. Show More. Market Cap. T. Market Weight. For the year period ended 7/29/22, the cumulative total return on the S&P Consumer Discretionary Index was %, compared to %. What is next for consumer discretionary stocks. US consumers bucked expectations in Will they do it again in ? “S&P'S GICS Consumer Discretionary Sector Index is cap-weighted Undervalued, Overvalued. Agenda. Sector Overview. Business Analysis. Economic. Undervalued Consumer Cyclical Stocks ; Adient PLC. ADNT · $ ; Advance Auto Parts Inc. AAP · $ ; Alibaba Group Holding Ltd ADR. BABA · $ ; sblanding.ru XLY tracks a market-cap-weighted index of consumer-discretionary stocks drawn from the S&P Sector. Sector. Asset Class. Equity. Region. North America. Good long term consumer discretionary stock? I have an IRA portfolio set up that I manage myself. I'm within about years of retirement. %. 1Y. %. Key Executive exercised options and sold Rm worth of stock. Aug ITE. R Italtile. 7D. %. 1Y. %. Now 20% undervalued. Aug Academy Sports & Outdoors (NASDAQ:ASO) is the third most undervalued consumer cyclical stock based on WallStreetZen's Valuation Score. Academy Sports & Outdoors.

Consumer discretionary. Consumer staples, Energy, Materials. Utilities They are “undervalued” and cost less than they should according to analysts' estimates. Consumer cyclicals are stocks of companies making consumer products that are greatly influenced by the ebbs and flows of the business cycle. The boom and bust. consumer discretionary, industrials, and health-care sectors among hedge funds? Whether or not these stocks are undervalued, or hedge. Consumer staples and consumer discretionary stocks tend to perform well over different parts of the economic cycle. For example, when deciding upon. Top stocks in the consumer discretionary sector include companies involved in retail, ecommerce, hotel, luxury goods, and leisure and travel industries. This page shows information about the 50 largest consumer discretionary sector stocks including Netflix, Walt Disney, Comcast, and NIKE. Undervalued Stocks (DCF w/Earnings) for Aug ; GM Logo, General Motors · GM · Consumer Discretionary ; COF Logo, Capital One Financial · COF. Consumer Discretionary Sector Stocks ; Market Cap. 7,B ; Revenue. 4,B ; Profits. B ; PE Ratio. ; Profit Margin. %. consumer discretionary stocks. And meanwhile, that long-awaited recession still failed to materialize, leading to unforeseen weakness among defensive. The Consumer Discretionary Select Sector Index is a modified cap SPECULATIVE: Deeply undervalued but risky. A rating of SPECULATIVE indicates. RXI is another consumer discretionary ETF to choose from. It has an expense ratio of % and net assets of $ Million. This ETF is composed of global. consumer discretionary stocks tend to shine Explore three undervalued stocks with strong fundamentals in the entertainment, distribution and automotive parts. Not surprisingly, their stocks' share prices usually follow on this pattern. Key Takeaways. Consumer discretionary refers to non-essential goods and services. The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies. Top 5 Consumer Stocks That May Crash. The estimated P/E Ratio for S&P Consumer Discretionary Sector is , calculated on 27 August A P/E less than (μ - σ) is defined "Undervalued". Undervalued Stocks United States · World ADRs · Marijuana Stocks · Top Bank Stocks Assess the S&P/TSX Capped Consumer Discretionary Index stock price and. undervalued. Cyclical stocks tend to have a far lower P/E ratio as a In this case, consumer discretionary stocks. This ETF is just one of many. Consumer Discretionary. Internet & Direct Marketing Retail. $. Valuation – search for undervalued companies;; Profitability — rating of. The day moving average is a long-term indicator that takes into account the average price of a stock over the past trading days. It is considered a. Over the last 7 days, the Consumer Discretionary industry has risen %, driven by gains from Pet Center Comércio e Participações of 49%. In the past year, the.

Best Web Hosting Cheap

What is the cheapest web hosting service? DigitalOcean Droplets start at just $4/month and include comprehensive features to support your company's website. We chose Hostinger as the best cheap web host of for its great price, quality content delivery network (CDN), and proven reputation. Start small and spend less. Ideal for setting up your personal website, WordPress blog or business landing page, these hosting plans are simple and affordable. Bluehost continues to distinguish itself from competitors by offering 24/7 support, affordable website hosting packages, website security and a comprehensive. Your Website is Faster & Safer on our Platform · SSD Storage Arrays · Best Speed Technologies · Built-in Scalability · Advanced Security · Stable Hosting Platform. Cheap Web Hosting · $/mo. · We're the largest hosting provider around. · Our websites load faster and deliver performance and security. · Simple and easy. In this guide, we'll share with you the 9 best cheap hosting services, their pros & Cons, and their pricing details. Check out the selection below for the best values in the web hosting industry with the best prices and promos refreshed every day. Cheap Web Hosting · $/mo. · We're the largest hosting provider around. · Our websites load faster and deliver performance and security. · Simple and easy. What is the cheapest web hosting service? DigitalOcean Droplets start at just $4/month and include comprehensive features to support your company's website. We chose Hostinger as the best cheap web host of for its great price, quality content delivery network (CDN), and proven reputation. Start small and spend less. Ideal for setting up your personal website, WordPress blog or business landing page, these hosting plans are simple and affordable. Bluehost continues to distinguish itself from competitors by offering 24/7 support, affordable website hosting packages, website security and a comprehensive. Your Website is Faster & Safer on our Platform · SSD Storage Arrays · Best Speed Technologies · Built-in Scalability · Advanced Security · Stable Hosting Platform. Cheap Web Hosting · $/mo. · We're the largest hosting provider around. · Our websites load faster and deliver performance and security. · Simple and easy. In this guide, we'll share with you the 9 best cheap hosting services, their pros & Cons, and their pricing details. Check out the selection below for the best values in the web hosting industry with the best prices and promos refreshed every day. Cheap Web Hosting · $/mo. · We're the largest hosting provider around. · Our websites load faster and deliver performance and security. · Simple and easy.

Get Premium Features with the Best Cheap Web Hosting plans from AccuWeb Hosting. Choose from highly reliable feature-packed hosting plans at a low price. This hosting review focuses on the five best cheap hosting plans available plus one free hosting option from Google. Check out the selection below for the best values in the web hosting industry with the best prices and promos refreshed every day. End your search now and save big on our cheap web hosting plans with Free Domain, cPanel, Unlimited Traffic, Unlimited email accounts and tons of features. Overall, I would say Hostinger is your best option if you're a beginner looking for an affordable price with tons of features. You can get. Hostinger offers shared hosting plans from $ per month, which is incredibly cheap, especially in comparison to many other providers in the list. GoDaddy, in. What is the cheapest web hosting service? DigitalOcean Droplets start at just $4/month and include comprehensive features to support your company's website. SeekaHost comes up with the best ever hosting plans, without compromising the resources and reliability. Build your Website and Blogs with SeekaHost for a. Hostinger is the best overall cheap web hosting provider. For less than $3 per month, you will get access to a free domain, unlimited bandwidth, fast SSD. Need more resources? Level up your project with all-in-one cheap web hosting by Hostinger. Take advantage of easy-to-use tools fit for veteran webmasters for. The best cheap web hosting service for most people is Hostinger or Bluehost. Cheap web hosting is an excellent option for brand new websites. Over the years, Hostinger has chalked up a reputation for crafting plans that meet the expectations of website developers, administrators, and visitors. The. Get cheap web hosting that's packed with value · Kick start your project with a cheap hosting plan · Unbeatable features with IONOS · FAQ – Cheap Hosting · Still. Need cheap web hosting? HoboHost's packages start at $1. cPanel license, Wordpress installation and SSL certificate included. Save $ now. We chose Hostinger as the best cheap web host of for its great price, quality content delivery network (CDN), and proven reputation. DreamHost is an affordable, robust web host. Shared hosting, VPS, Cloud and Dedicated hosting are all available, each with their own respective plans, making. Web host B costs $ a month, but you can host unlimited websites, can have unlimited traffic, and it comes with email hosting. What's a better value? Clearly. As far as pricing is concerned, DreamHost made it into our list as a cheap web host thanks to its affordable WordPress hosting plans and low-cost cloud object. I have had great luck with sblanding.ru - their customer service is top-notch and they were quick to implement sblanding.ru I moved all my sites (5).

No Tax Return Home Loans

A Bank Statement loan is a home loan program designed for self-employed/ business owners. For qualification purposes, the lender uses the deposits made into the. The Loan Originator must compare the income and expense information provided by the applicant with the last two complete. Federal Income Tax Returns (IRS Form. Our Bank Statement Loan program is for self-employed home loan borrowers who can qualify with a bank statement instead of tax returns or pay stubs. No Tax Returns Required. No employment verification required. Qualify using months Business or Personal Bank Statements. Available for Purchase and Cash-. Fidelity Home Group offers a 1-Year Tax Return Loan Program for Self-Employed / Business Owners as well as those whose employment histories and tax returns may. No-income loans allow you to take out a loan for a primary residence without having an income or without showing taxable income on your tax returns. A bank statement loan is a type of non-qualified mortgage loan that allows you to qualify based on bank statements instead of tax returns and W-2s. So you have to file taxes retaining as much income as you need to qualify, for the mortgage and pay back taxes. Then you have to wait for the. I'm interested in getting an FHA loan, but have no verifiable income. I kind of exited the system in and stoped using State ID as well. A Bank Statement loan is a home loan program designed for self-employed/ business owners. For qualification purposes, the lender uses the deposits made into the. The Loan Originator must compare the income and expense information provided by the applicant with the last two complete. Federal Income Tax Returns (IRS Form. Our Bank Statement Loan program is for self-employed home loan borrowers who can qualify with a bank statement instead of tax returns or pay stubs. No Tax Returns Required. No employment verification required. Qualify using months Business or Personal Bank Statements. Available for Purchase and Cash-. Fidelity Home Group offers a 1-Year Tax Return Loan Program for Self-Employed / Business Owners as well as those whose employment histories and tax returns may. No-income loans allow you to take out a loan for a primary residence without having an income or without showing taxable income on your tax returns. A bank statement loan is a type of non-qualified mortgage loan that allows you to qualify based on bank statements instead of tax returns and W-2s. So you have to file taxes retaining as much income as you need to qualify, for the mortgage and pay back taxes. Then you have to wait for the. I'm interested in getting an FHA loan, but have no verifiable income. I kind of exited the system in and stoped using State ID as well.

Borrowers can still find loans that do not require tax returns or other traditional income-verifying documents. Instead, the lender allows you use other. Stated income loans were created for self-employed individuals that do not qualify for a traditional mortgage due to the low income on their tax returns. However, stated income loans require no income documentation nor tax returns for self-employed borrowers. home without having to provide tax returns and too. Stated income loans were created for self-employed individuals that do not qualify for a traditional mortgage due to the low income on their tax returns. Truss Financial Group can help you qualify and get the best rate, term, and fees on a No Tax Return HELOC. We offer “No-Doc” home equity line of credit. In order to make the process of obtaining a mortgage without a W2 a bit easier you should be prepared to show your broker your previous year's tax returns (some. It's not called an installment loan, it's a payment plan. As long as the IRS has not filed a lien against you, you will be able to refi. The. Why? Simply said, there is no income documentation, income verification, or tax returns, and you will not be asked to provide any bank statements on most. True "No Income - No Employment - No Tax Return" Loan for self employed, w-2 and retired borrowers. Income and Employment are not listed or verified. Available. It's no secret: when you apply for a mortgage, lenders want to know that you can repay the loan. To assess your financial situation and determine whether or not. Home equity loan interest. No matter when the indebtedness was incurred, you can no longer deduct the interest from a loan secured by your home to the extent. A no-income-verification loan can make sense in certain situations: if you can't easily verify your earnings, you have complicated tax returns or you want to. A no income verification mortgage is often referred to as a no doc mortgage as the name implies, this type of loan does not require the lender to verify how. Our amazing No-Doc Mortgage Loan program offers low rates and great terms for residential investment properties. No income documentaion, no tax returns. Perhaps most creative of all, you can qualify for a mortgage loan without tax returns by simply providing a letter stating your title, ownership percentage, and. No Income Verification Mortgages. No Income Verification mortgage program is a perfect fit for investors who don't qualify for traditional financing based on. Why? Simply said, there is no income documentation, income verification, or tax returns, and you will not be asked to provide any bank statements on most. Home equity loan interest. No matter when the indebtedness was incurred, you can no lon- ger deduct the interest from a loan secured by your home. Unlike conventional loans, a no-documentation mortgage loan requires no income verification from the borrowers - instead, these mortgage programs are based on.

1 2 3 4 5 6